At Consumer Energy Solutions we are always researching how our commercial customers can save money and take advantage of energy efficiency programs available to them. One great tax deduction that is often very misunderstood and underused is the Energy-Efficient Commercial Building Tax Deduction which is in the current IRS Tax Laws at Section 179D. This is also called EPACT.

Commercial buildings are being strongly encouraged these days to comply with higher energy efficiency standards. With EPACT, if a building owner can achieve an overall building savings amounting to a 50% reduction in total annual energy and power costs they can qualify for this deduction which can be up to $1.80 per square foot!

Energy efficient buildings that qualify for these substantial tax deductions through Section 179D include structures of more than 20,000 square feet and are:

- New commercial and municipal buildings

- Retrofitted buildings

- LEED buildings (Leadership in Energy and Environmental Design (LEED) is a set of rating systems for the design, construction, operation, and maintenance of green buildings, homes, and neighborhoods.)

EPACT expires midnight, December 31, 2015. To take advantage of all the deductions possible, energy efficiency improvements must be purchased and put into service by then. So that’s the first thing you need to know. That means there are about 6 months left to take advantage of EPACT deductions.

Here are some of the basics and specifics of Section 179, EPACT.

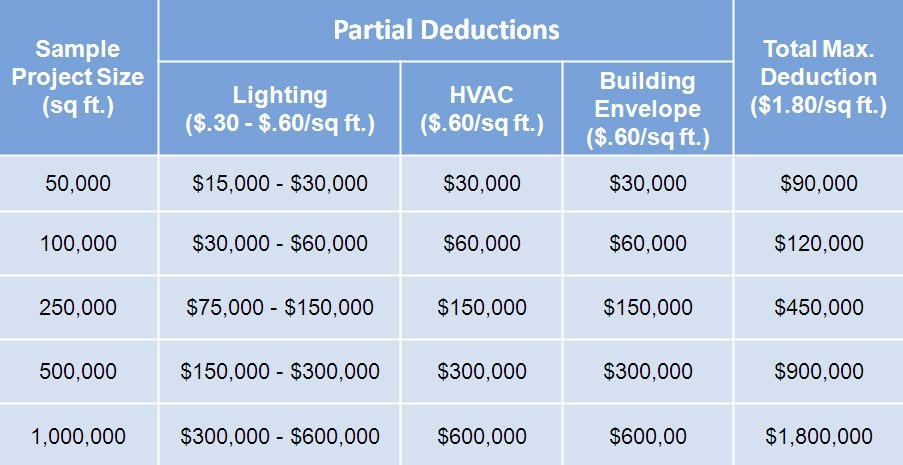

There are three categories for potential deductions under Section 179D. They are:

- HVAC1: $0.60 per square foot

- Interior Lighting: $0.60 per square foot

- Building Envelope2: $0.60 per square foot

You can take these deductions if you are:

- Owners of energy efficient commercial or multifamily properties built or retrofitted since 12/31/2005.

- Architects, engineers, ESCOs3, and designers of energy efficient municipal building projects. (LEED certified buildings easily qualify.)

To qualify for the deductions described above, the building needs to show 20% energy and power cost savings for HVAC improvements, 20% for lighting improvements, and 10% for building envelope improvements (overall building savings of 50%).

The building must be certified as meeting these specific energy reduction targets as a result of improvements in interior lighting; building envelope; or heating, cooling, ventilation, or hot water systems. A certification letter is required in order to claim the Section 179D tax deduction and must be signed by an engineer or contractor who is licensed in the area in which the building is located and is qualified to do this type of building analysis. Energy savings are calculated using qualified computer software approved by the IRS.

The tax deductions are taken in the year when construction is completed.

The chart below shows what the deduction can be in various sizes of projects. For example in the 250,000 square foot building, if they qualify for the full $0.60 in each category, the total deduction taken can be $450,000!

Talk to your tax accountant and find out if you qualify or can qualify for this great deduction this year.

And call us at CES if you have any questions about upgrading your building’s lighting to amazingly energy efficient LED lighting. It’s easier than you think!

You can have a free consultation to find out about LED lighting

for your business by contacting:

Jeannine Forte

jforte@cesstaff.com

844-277-0043

[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][1] HVAC: Heating, Ventilation and Air Conditioning.

[2] Building envelope: the physical separators between the conditioned and unconditioned environment of a building including the resistance to air, water, heat, light and noise transfer. The three basic elements of a building envelope are a weather barrier, air barrier, and thermal barrier.

[3] ESCO: Energy Service Company or Energy Savings Company. A commercial or non-profit business providing a broad range of energy solutions including designs and implementation of energy savings projects, retrofitting, energy conservation, energy infrastructure outsourcing, power generation and energy supply, and risk management.

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]