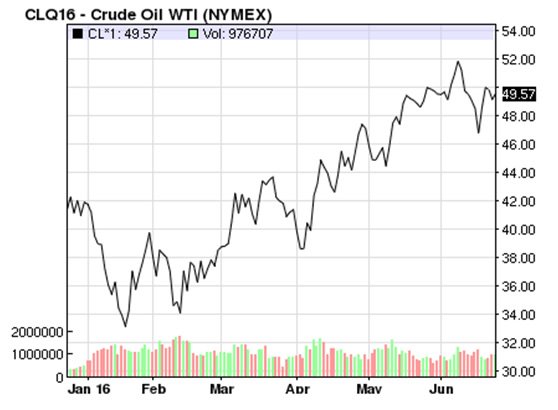

Price per Barrel of Oil in 2016

Crude oil prices have been hovering recently at the $50 a barrel level. This is a kind of make-break point economically. It’s not a steep enough rise to cripple very fuel-reliant industries like airlines and railroads and it is also a low enough price to boost economic growth in many countries, including the U.S. (per the Wall Street Journal report on May 27, 2016). You can see from the graph above that this follows a rather sharp rally in oil prices since the beginning of the year.

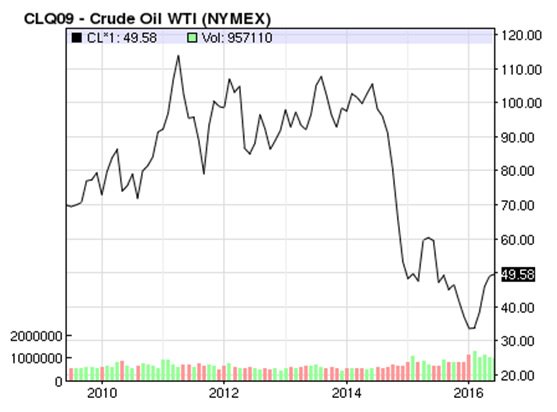

However, a little history is shown in the graph below and it puts this all into a different perspective. A seven year overview shows that oil broke $100 per barrel. In fact oil prices reached the record high of $145 a barrel in 2008, and again rose above $100 a barrel in 2011, hanging out in that range through 2014.

One can easily see that the price per barrel could continue to go up in the near future.

Putman Investments points out that the recent rally in oil prices has given hope to some commodity-related companies that were facing almost certain bankruptcy had the price of oil stayed below $30. In spite of the oil price rally, the continued deterioration in the fundamentals underlying the credit market has kept production from significantly increasing. And though the rally in oil prices has staved off bankruptcy for some companies, it may be too little, too late for others.

Banks periodically assess an energy company’s “borrowing base” by estimating the value of the company’s assets to determine how much they are willing to lend in the form of direct loans, lines of credit, etc. The spring of 2016 showed that some energy company’s borrowing bases were marked down 20%. This is a significant drop in the asset side of their balance sheet and some of these companies may not survive.

CNBC reported on June 9, 2016 that per Tapstone Energy CEO, Tom Ward, for U.S. oil companies specifically, until capital markets open up and allow companies to spend outside of their cash flow, production will not increase and crude prices will continue to rise. He stated, “I wouldn’t be surprised at all if we saw above $60 or even $70 [fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][a barrel] by the end of the year.”

His comments come on the heels of American oil billionaire Harold Hamm’s prediction that oil will likely hit $69 to $72 per barrel by year’s end.

We watch all this in the energy industry as there is a correlation between the price of oil, the price of natural gas and the cost of electricity.

If you are in a deregulated state, contact Consumer Energy Solutions today to get the best price in the current market for your natural gas and electricity. We work with the biggest, most competitive energy suppliers in the industry and will do the shopping for you. Visit our website at www.ConsumerEnergySolutions.com[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]