The current low prices for natural gas in the U.S. make it very difficult for companies to spend money on more drilling. And yet, the U.S. is producing more natural gas than ever in 2015. In fact, the government’s Energy Information Administration forecasts a 5.4% increase in output this year compared to 2014.

However, the new numbers from EIA suggest some potential trouble just ahead for gas production, especially in the 7 top shale formation regions that have produced a majority of the increase in U.S. oil and gas production.

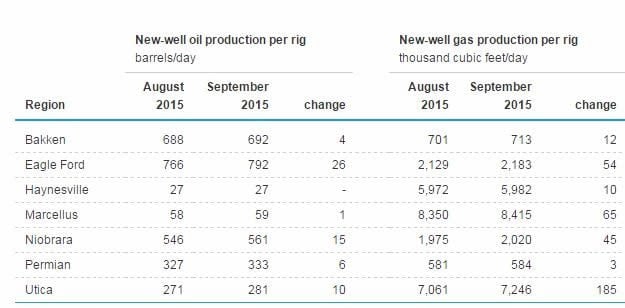

In its August Drilling Productivity Report, EIA forecasts that gas production will decline in all seven of the United States’ major shale regions in September, the first across-the-board slump in shale gas1 production ever recorded by the agency.

The report reflects a real slow-down.

In May, production reached an all-time high of 45.6 billion cubic feet a day in the shale regions, including the United States’ largest gas field, Marcellus in Pennsylvania. By September, the daily output is expected to fall to 44.9 billion cubic feet, according to EIA’s projections.

The other shale formations are Bakken in North Dakota, Eagle Ford in Texas, Haynesville in Louisiana and Texas, Niobrara in Colorado, Permian in Texas and Utica in Ohio.

EIA uses a relatively simple calculation for the report, comparing estimates of production from existing wells with that expected from newly drilled wells, based on the number of drilling rigs in operation. In its latest assessment, the agency concludes that output from new wells in shale formations will fall short of making up for decreases in production from older wells next month.

“Given the substantial drop in rig counts since the fourth quarter of 2014 in each of the (shale) regions and growing declines in production from older wells, productivity increases are less able to completely offset lower rig counts and legacy well declines,” the report explains.

That said, the decline doesn’t appear so great as to upset EIA’s projections for gas production in the U.S. as a whole, including gas from other, conventional onshore wells and wells in the Gulf of Mexico. In fact, the agency in its “Short Term Energy Outlook” for August predicted that total U.S. gas production would climb by 4 billion cubic feet per day in 2015 compared to 2014, reaching 78.7 billion cubic feet per day, with improvements in drilling efficiency offsetting low prices.

But that growth tapers off in 2016, with total U.S. gas production rising 1.8 billion cubic feet per day, for a daily total of 80.5 billion cubic feet.

Production in the first half of 2015 was well above the first half of 2014, so even if we have declining production now, just averaging over the year will give you an increase in 2015 over 2014. “In 2016, you’ll start seeing the price effect.”

The Henry Hub spot price for gas – the U.S. benchmark for natural gas – was $2.63 per million British thermal units last Thursday, down 34.5% from the same day one year ago. At that time, the price was $4.02.

It is important to note that the drilling report doesn’t take into account economic factors, such as changes in the price of gas, or new infrastructure to carry gas from shale formations.

For example, the 1,698-mile Rockies Express Pipeline, originally built to carry gas east from Colorado and Wyoming, just recently began shipping gas west from the Marcellus and Utica shale formations, opening new markets and potentially providing higher prices for producers in those regions.

And with near-record levels of inventory, the U.S. gas industry will head into the winter heating season with more than enough supply to meet demand.

I think it is fair to say that while this report may not be able to tell us everything to expect, it is a good indicator of changes in direction of the marketplace.

Natural gas prices and electricity prices mirror each other. It looks like prices could be going up this winter. Now is a good time to lock in your long-term energy rates.

1 Shale gas refers to natural gas that is trapped within shale formations. Shales are fine-grained sedimentary rocks that can be rich resources of petroleum and natural gas. Sedimentary rocks are rocks formed by the accumulation of sediments at the Earth’s surface and within bodies of water. Common sedimentary rocks include sandstone, limestone, and shale.