The energy industry has been in the news this year and accompanying the news is a national cry for energy independence. A step along the way towards achieving that for the U.S. would be to gain North American energy independence. That would mean weaning North America (the U.S., Canada and Mexico) off any kind of dependence on oil from countries that are openly hostile to U.S. foreign policy and interests. Countries like Iran, Venezuela and Iraq. It would mean not being dependent on Russia for oil. It would also mean not being dependent on countries with questionable human rights practices like Saudi Arabia.

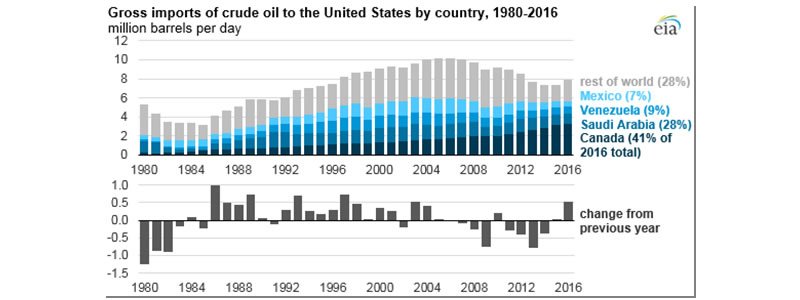

In 2016 the U.S. imported 7.9 million barrels per day of crude oil—up over 2015. The graph above shows the U.S. oil imports since 1980. It’s interesting to note that in the category of “rest of world (28%)” are countries like Iraq and Nigeria!

Currently in North America there are 15,279 miles of pipeline under construction which will carry oil and natural gas.1

Here at Consumer Energy Solutions we keep an eye on what natural gas is doing. Why? Because electricity prices tend to follow natural gas prices. We are always working to get our customers the best electricity and natural gas prices available in the current market.

So, what would energy independence mean as far as natural gas is concerned?

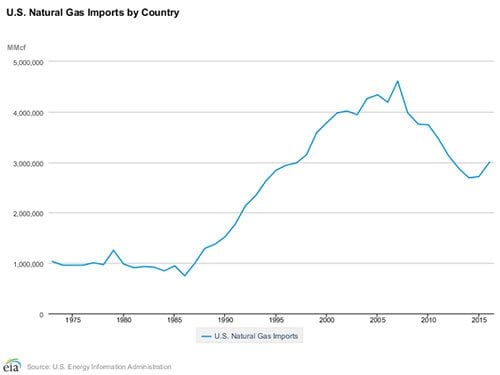

Here’s an interesting graph that shows how much natural gas the U.S. imported through 2016 from other countries—mostly Canada.

Here’s an interesting graph that shows how much natural gas the U.S. imported through 2016 from other countries—mostly Canada.

The US Energy Information Administration (EIA) reported in June, 2017 that in 2016 there was a reduction of natural gas production, the first in 11 years. In fact there had been a negative production growth for 14 consecutive months. In January, 2017 gas production increased and it has been slightly increasing since. The expectation is a boost in gas production throughout 2017 and 2018. The EIA also predicted that natural gas prices are expected to go higher and continue to rise through 2018.

The other aspect to understand about natural gas is the supply. There are three components to gas supply: conventional gas production, shale gas production, and imported gas.

Since 2008 conventional gas production has been in a decline and this drove production prices up. Shale gas production has gradually increased and now makes up 2/3 of domestic supply. Shale gas production must continue to grow to offset falling conventional supply.

The apparent lower cost of shale production is only low-cost compared with the higher prices that resulted from the depletion of conventional gas fields.2

There is not an infinite supply of gas in these shale fields. Forbes reports that there is about a decade or so of normal supply before facing another period of gas scarcity.3

We import a great deal of natural gas from Canada but this has been on the decline since the early 2000s. It is projected that the importing of natural gas is expected to continue to decline through 2040.

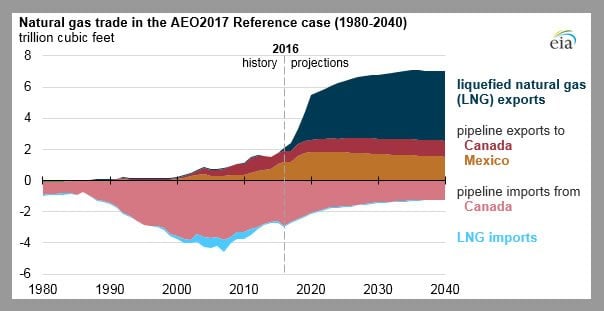

Here’s an EIA graph that shows the history of imports/exports through 2016 and then projections through 2040.

The supply of natural gas has remained somewhat flat (tight) and the demand has been slightly rising with increased domestic consumption and exports. For instance there has been increased production in the Permian Basin in Texas but almost 40% of that gas goes to Mexico.

These are swiftly changing energy times we’re in. The final stage of the Keystone Pipeline is running into delays so it is unknown when this will get done. The Dakota Pipeline now has oil flowing through it but legal challenges are still in the future. There are a lot of unknowns about our energy independence.

One thing we know is that in the last month, natural gas prices have been falling. This means we at CES can help those in deregulated states get great prices on their electricity and natural gas now. Best to take advantage of this time and these prices, tomorrow could be a different story. Call us today at 866-748-2669 to see how we can help you.

1 https://pgjonline.com/2017/01/03/pgjs-2017-worldwide-pipeline-construction-report/

2 https://www.forbes.com/sites/arthurberman/2017/07/05/shale-gas-is-not-a-revolution/#6174bdea31b5

3 https://www.forbes.com/sites/arthurberman/2017/07/05/shale-gas-is-not-a-revolution/#6174bdea31b5