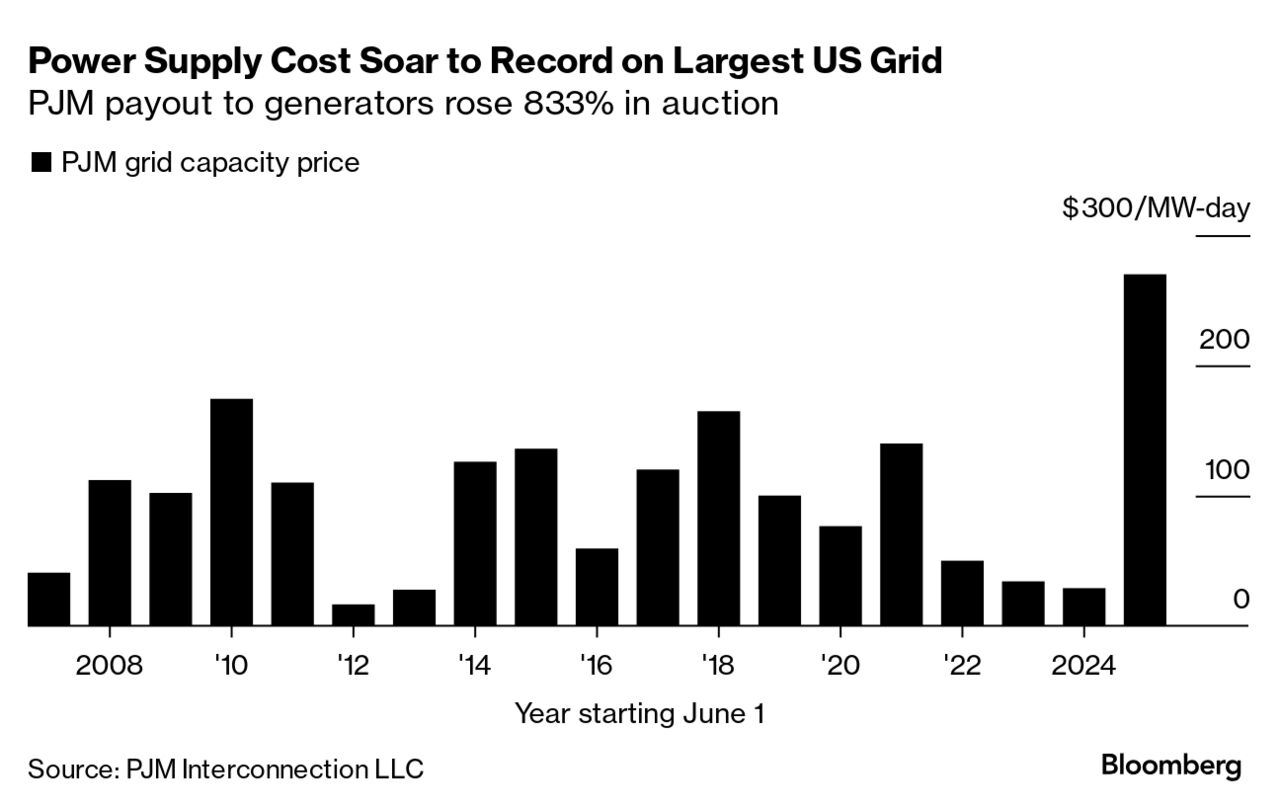

PJM Capacity Auction Skyrockets 833% – Is This Going to Affect Energy Pricing?

Prices at PJM’s annual capacity auction skyrocketed to $269.92 an increase of 833% over the previous year which closed at $28.92 as supply dwindled and demand increased. This means customers will pay $14.7 billion for capacity in the 2025/26 delivery year, a $12.5 billion increase over the previous year. This could increase wholesale energy costs by as much as 29% starting in mid-2025, when the capacity purchased in this auction is due for delivery.

The PJM, is a regional transmission organization (RTO) that coordinates the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia.

One of the major functions of the PJM is its capacity auction. This auction plays a crucial role in ensuring future electricity reliability by securing enough power generation capacity to meet anticipated demand. Power generators and other capacity providers bid to supply electricity for future periods. PJM then selects the lowest-cost bids to meet the forecasted demand.

Auction prices were significantly higher across the RTO due to a large number of generator retirements, increased electricity demand and government approved market reforms.

What does this mean for customers?

Customers will face significantly higher electricity costs in 2025 due to the spike in capacity prices. This will particularly impact energy-intensive industries, where electricity constitutes a major part of operating expenses. Re-evaluating your budgets and energy resources will be key.

You may be able to pass on the increased costs to customers through higher prices for goods and services, however, this may not be feasible in highly competitive markets.

Higher energy costs provide a strong reason for homes and businesses to invest in energy efficiency measures and technologies to reduce overall consumption.

In conclusion, the 833% increase in capacity prices represents a significant challenge for both businesses and residential customers across the affected electricity markets. This surge will lead to higher operational costs, necessitating strategic adjustments in energy procurement, efficiency investments, and overall financial planning. While the immediate impact is likely to be an increase in expenses, it also presents an opportunity for businesses to innovate, improve efficiency, and invest in sustainable energy solutions. There is an edge to be gained. This is where a solid, reputable, long tenured energy brokerage is essential.

Let us help you minimize the impact these increases will have on your budget.