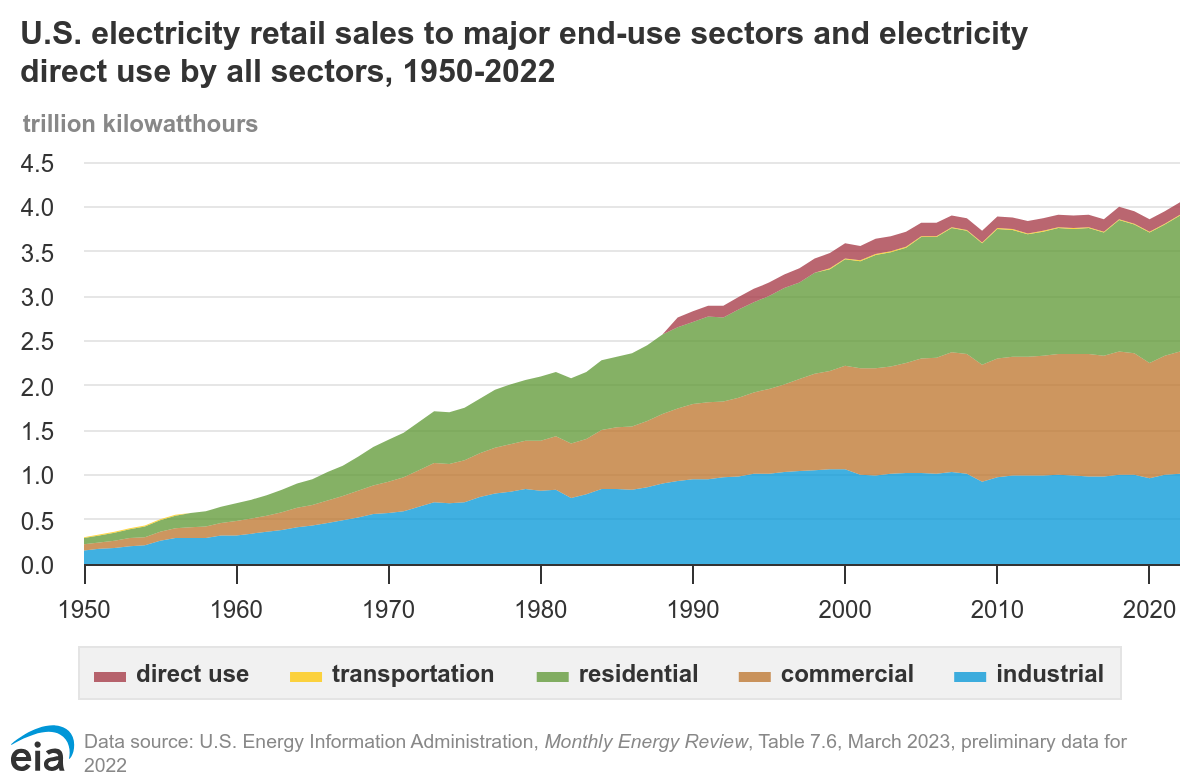

Rising Electricity Demand Could Drive US Wholesale Prices 19% Higher Over the Next 4 Years

While new electricity generation from traditional sources and utility scale solar and wind could theoretically meet this expected demand growth, there are significant challenges in getting these new sources built, such as massive upgrades to the eclectic grid, finding suitable locations to build clean energy infrastructure, keeping up with the retirement of traditional sources of electricity generation, etc.

Because of all these challenges we’ve previously decommissioned power plants and power plants scheduled to be shut down be brought back online or had their shutdown dates pushed back. This includes for the first time in American history a decommissioned nuclear power plant in MI receiving a $1.5 billion dollar loan to resume operations by late 2025.

The Driving Factors Behind Increased Demand

There are several factors contributing to the expected growth in electricity demand, but some of the largest factors are:

- Electric Vehicles

- Massive expansion of large-scale data centers for artificial intelligence, cryptocurrency mining, etc.

- Manufacturing fuel cells and batteries

On top of all this there is a growing need for massive energy storing solutions to make intermittent power sources (wind and solar) viable alternatives.

These demand increases combined with the challenges in building enough new generation could increase the cost utilities pay for wholesale electricity by an average of 19% by 2028. These additional costs will be passed on to homes and businesses.

Because of this we are advising many of our customers to look at longer term contracts (2-3+ year fixed rates) to protect their home and/or business from any price increases.

While longer contracts are correct for many customers, they are not correct for all. Where you are located, zoned, how much energy you’re using, how efficiently you use energy, your risk tolerance, etc. all affect what plan will be best for your specific needs.