Here’s an interesting 2017 news alert: “Throughout Q1, crude inventories in the U.S. continued to climb, which started to raise concerns about the impact of the OPEC cuts,” said Mark Watkins, regional investment manager at the Private Client Group at U.S. Bank in Utah. “March hit the oil markets like a lion, with WTI1 falling approximately $5 dollars a barrel.”2

But will prices continue to drop?

As we talked about in last month’s newsletter, in 2014, OPEC made some decisions that basically sent the price per barrel of oil plummeting and put OPEC into a price war with the U.S. In the past OPEC has tried to influence the price of oil by deciding to either cut back or boost production. By November, 2014, as the price of oil was precipitously dropping, OPEC members argued about cutting back production in order to prop up the price of oil. Some of the member countries of OPEC need the higher prices to break even on their budgets and pay for government spending (like Venezuela and Iran). But the world’s largest oil producer, Saudi Arabia, was opposed to cutting prices and willing to let prices keep dropping.

In the end, OPEC couldn’t agree on a response to the plummeting prices and ended up keeping production unchanged and continued to literally glut the market with its oil production.

The fact of the matter is that this was a “price war” with the U.S. because at the time it was very cheap to pump oil out of places like Saudi Arabia and Kuwait, but was more expensive to extract oil form shale formations in places like Texas and North Dakota where there was an oil production boom of sorts happening. The decisions of OPEC at that time drove some U.S. producers out of business. The perceived benefit to OPEC was that eventually prices would stabilize and OPEC would maintain its market share.3

So now we look at the state of things in 2017. In January, 2017, OPEC agreements to cut production went into effect for 6 months. These cuts were designed to raise prices and help ease the budget pressures of OPEC member countries. We find that U.S. shale producers are returning to the market after being run out of the market in 2014’s collapsing oil prices. In fact the reported number of active oil rigs in the U.S. has risen every week this year but one.4

So now we look at the state of things in 2017. In January, 2017, OPEC agreements to cut production went into effect for 6 months. These cuts were designed to raise prices and help ease the budget pressures of OPEC member countries. We find that U.S. shale producers are returning to the market after being run out of the market in 2014’s collapsing oil prices. In fact the reported number of active oil rigs in the U.S. has risen every week this year but one.4

The next OPEC meeting is May 25 where they are expected to extend agreements about cuts in production beyond June, 2017.5

Per Kiplinger Economic Forecasts, “We look for oil prices to increase this summer, but only slightly. In August, we expect WTI to trade from the high $40s to low $50s per barrel.”6

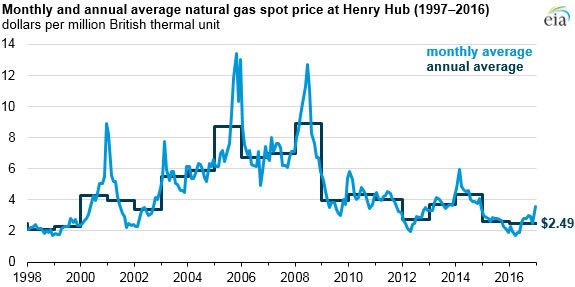

The U.S. Energy Information Administration (EIA) estimates that residential electricity rates will increase by 3% for 2017. If you look at the available charts at the U.S. Energy Information Administration site7 all predictions are that oil prices will be going up. We recently came off the lowest price for natural gas since 1999 and these graphs also seem to be now turning up.

As we move into the summer season, demand for energy will increase once again, thus on the short term rates are likely to go up. You can “beat the system” by locking in the best rate in the current market, now. With energy politics as they are, with the likelihood of prices increasing, this spring could truly be the calm before the storm of supply and demand that drives electricity and natural gas prices up.

Call Consumer Energy Solutions today for a Free Rate Analysis.