“Inflation” refers to a general increase in the prices of goods and services in the economy over time that corresponds with a decrease in the value of money. When a unit of currency depreciates in value, so does its purchasing power. It takes more currency units to buy the same amount of goods and services than it did in the past. In other words, your money buys you less.

Inflation can hurt everyday consumers, savers, and fixed-income investors.

- Inflation is a decrease in the purchasing power of currency due to a rise in prices across the economy.

- One of the reasons inflation happens is largely a result of increases in the money supply months or even years previously.

- Another notable observation about inflation is that although it is detrimental to the overall economy, it is beneficial to the government because it allows the government to pay back debt with “cheaper” dollars. Thus, the government has a constant desire for higher inflation while the people have a need for a healthy economy.

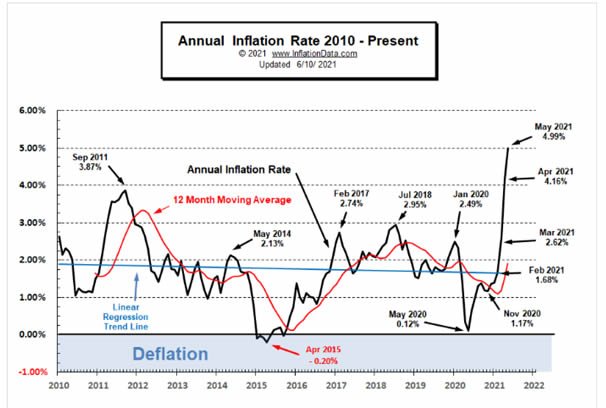

The Consumer Price Index 1 showed overall inflation for May 2021 rose nearly 5%. The key component in this hike is the increase in Energy prices which increased 28.5% over the last year. The “core inflation rate” 2 rose 3.8%. This figure excludes food and energy.

Crude oil prices recently topped $70.01—crude is basically up over 46% for the year. Oil prices reached new highs after 2 previous weeks of gains. Demand is coming back faster than supply to meet the demand. Goldman Sachs predicts prices to reach $80 per barrel this summer. All this is good news for the investor, but the public pays for it at the pumps.

The regular consumer is going to feel this most strongly at the gas pumps. The American Automobile Association national average for gas was just updated to $3.08 per gallon.

The regular consumer is going to feel this most strongly at the gas pumps. The American Automobile Association national average for gas was just updated to $3.08 per gallon.

There is a great deal of debate over how high inflation may get in the coming months.

But there’s no debate on why you should take steps now to lock in a fixed rate for your company’s electricity and natural gas. When you have a 1 year, 2 year, 3 year contract or more, that locks in a fixed rate—you will not have to worry during that time about your energy bill while the market does what it does.

If you are in a deregulated state, that next incoming call to your office could be us. When you hear Consumer Energy Solutions is on the phone, take the call and let us see if we can help you save money too.

If you’d like to take the reins and be pro-active, give us a call at 866-748-2669 for a Free Rate Analysis.

1Consumer Price Index (CPI): a monthly measurement of U.S. prices for household goods and services. It reports inflation (rising prices) and deflation (falling prices). The CPI measures the changes in the purchasing power of a country’s currency.

2Core inflation rate: the price change of goods and services minus food and energy. Core inflation rate is calculated using the Consumer Price Index excluding food and energy.