The effects of the PJM capacity auction for the 2025/26 delivery year are starting to show, as the Office of People’s Counsel for the State of Maryland released a report indicating that, depending on where you are located, your electric bills could rise by as much as 24% starting in mid-2025.

Why Maryland is Affected so Heavily by the PJM Auction

Maryland, like other PJM regions, is required to meet strict resource adequacy standards. These requirements ensure there is enough electricity supply during peak periods, but if capacity prices go up, utilities recover the increased costs from ratepayers.

The capacity costs for the upcoming delivery years of 2025/26 increased by $12.5 billion dollars to $14.7 billion compared to the previous 2024/2024 auction ($2.2 billion), and Maryland specifically accounted for almost $5 billion of the 2025/26 auction.

Some other factors driving prices up are:

Energy Transition Costs: The shift towards renewable energy and away from fossil fuels involves various costs, including investment in new infrastructure and technology. These energy transition efforts increase short-term costs, which are reflected in higher rates.

Market Conditions: Rising demand, fuel costs, and changes in market conditions—such as natural gas prices—affect the overall price of electricity. These factors combine with capacity market dynamics to create a compounding effect on Maryland’s energy prices.

Few Short Term Prospective Generation Projects: Maryland’s lack of new generation in the near term interconnection process is also a factor.

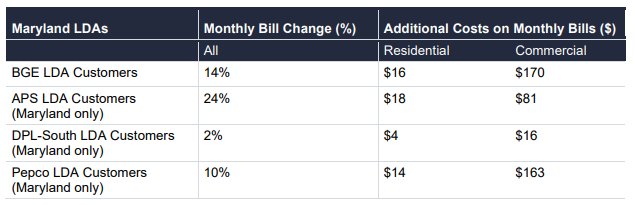

Price Increases by Delivery Areas

Maryland is broken up into 4 locational delivery areas (LDAs):

Baltimore Gas and Electric (BGE LDA), the only LDA entirely located in Maryland, which

is comprised of Baltimore Gas and Electric’s (BGE) Maryland service territory;

Allegheny Power System (APS LDA), which covers portions of Maryland, Pennsylvania,

Virginia, and West Virginia, including the service territory of Potomac Edison, which

serves customers in Western Maryland, and various municipal utilities in the APS LDA

footprint;

Delmarva Power South (DPL-South LDA), which covers Maryland and Delaware

portions of the Delmarva Peninsula, including Maryland utility Delmarva Power; and

Potomac Electric Power (Pepco LDA), which covers portions of Maryland and

Washington, D.C., including Maryland utilities Potomac Electric Power (Pepco) and

Southern Maryland Electric Cooperative (SMECO).

The driving factor for the rate increases are the reliability must-run (RMR) contracts for Talen’s Brandon Shores and Wagner power plants, which were planned to retire in mid-2025. Under the new contracts, the power plants will continue operating until transmission lines are built to address the area’s reliability issues — which PJM expects to finish by the end of 2028.

The RMR contracts for the Talen power plants likely drove up capacity prices across PJM by about $5 billion.

It is unclear how long capacity prices will remain high in PJM, in part because of the grid operator’s clogged interconnection queue, which could hamper power plant development..

The price spike in the last auction was mainly driven by power plant retirements, planned shutdowns like those of Talen, increased load and new market rules, according to PJM.

The capacity prices in Maryland reflect the need for power lines and power supplies, according to PJM.

Don’t wait for these price increases to take effect. Get a fixed rate today and avoid the increases.