So many opinions are out there on why prices are going up, why this or why that. But let me tell you a story about a small earthquake in the Netherlands in 2012.1

One of the world’s largest gas fields in the Netherlands, called Groningen, was a high-producing field intended to be a huge supplier of natural gas for Europe. But in 2012 there was a small earthquake caused by the removal of natural gas from the field and the ground became more porous and deflated resulting in a series of tremors and then the 2012 quake.

This little 2012 earthquake set off a chain of events that is still affecting us today—in fact the ripple effects of this earthquake are affecting the entire global economy and contribute to pushing energy prices higher and higher.

Let’s back up a bit. In 2012 this earthquake was not a big deal as far as earthquakes go. However, Groningen, an asset of Exxon Mobile and Royal Dutch Shell, was ordered in 2015 by the Dutch government to phase out of production. By next year, there will be no production of natural gas at all out of that field.

Now, Europe is presently experiencing a natural gas shortage. They are more and more dependent on getting natural gas from other places.

To add to that, winter is here. And to add to that, the global economy is roaring back from the pandemic and natural gas is in high demand. Why? Natural gas emits less carbon than coal and oil.

But Europe is pumping less natural gas, the Groningen field has all but closed and there has been a lack of investment in other sources to replace it.

How does all this affect us here in the US?

Well, the US is still one of the world’s largest exporters of natural gas. In fact, exports of liquified natural gas (LNG) are expected to hit record highs this year.

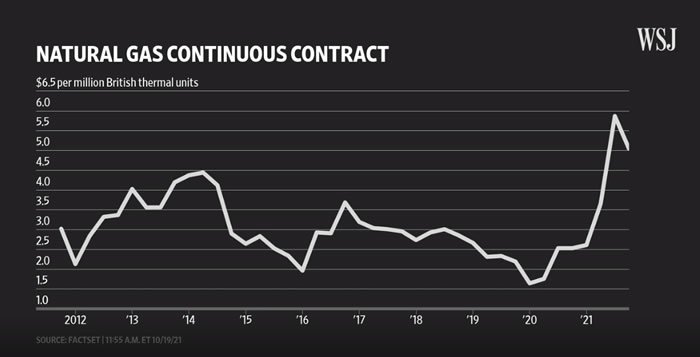

There is strong demand for US natural gas and there have been bidding wars abroad. This has helped drive natural gas prices to their highest point in a decade.

The demand for natural gas is so high that there is also an increased demand for coal and oil whose prices are also climbing.

So, what’s happening in Europe is affecting us here too.

Winter is a variable here at home. If it’s a warmer winter than usual we can expect to pay 22% more for our heating bills. If it’s colder than average, we will pay up to 50% more! And according to the Labor Department consumers in the US are already spending 25% more on energy than they were just a year ago.

And the issue of politics definitely affects supply and demand of gas. If world leaders are too eager to do away with fossil fuels as sources of energy and go “green” before it is truly viable, there are experts who advise that the global shortages and the price spikes that we are seeing right now could happen again and again in the years to come.

Increased demand globally, increased prices, winter at our door, not to mention how politics plays in all this, all add up to our energy bills going higher and higher. What can you do about it?

First, you need to understand the economics of it all and how rapidly the energy market changes. Second, let us help you now. Don’t wait. We have the ability to lock in energy rates that can help you feel secure about your bottom line as you ride out this uncertain time. Call today for a free quote. 1-866-748-2669.

1The story about the earthquake in the Netherlands can be found in its entirety here: https://www.wsj.com/video/series/shelby-holliday/why-a-small-dutch-earthquake-is-having-a-big-impact-on-gas-prices/78F2FD36-9FC9-4A8E-9E4C-DDBBEBD954A4