Updated: 12/19/2022

In this article we are going to cover the main factors that are driving energy prices so high and where the market is likely to go as a result.

The factors that drive energy prices up and down can be broken down into 6 categories:

- Supply

- Demand

- Weather

- Long term market conditions

- Law and regulation changes

- Infrastructure maintenance, repair and construction

Let’s look at each of these in detail.

Supply & Demand

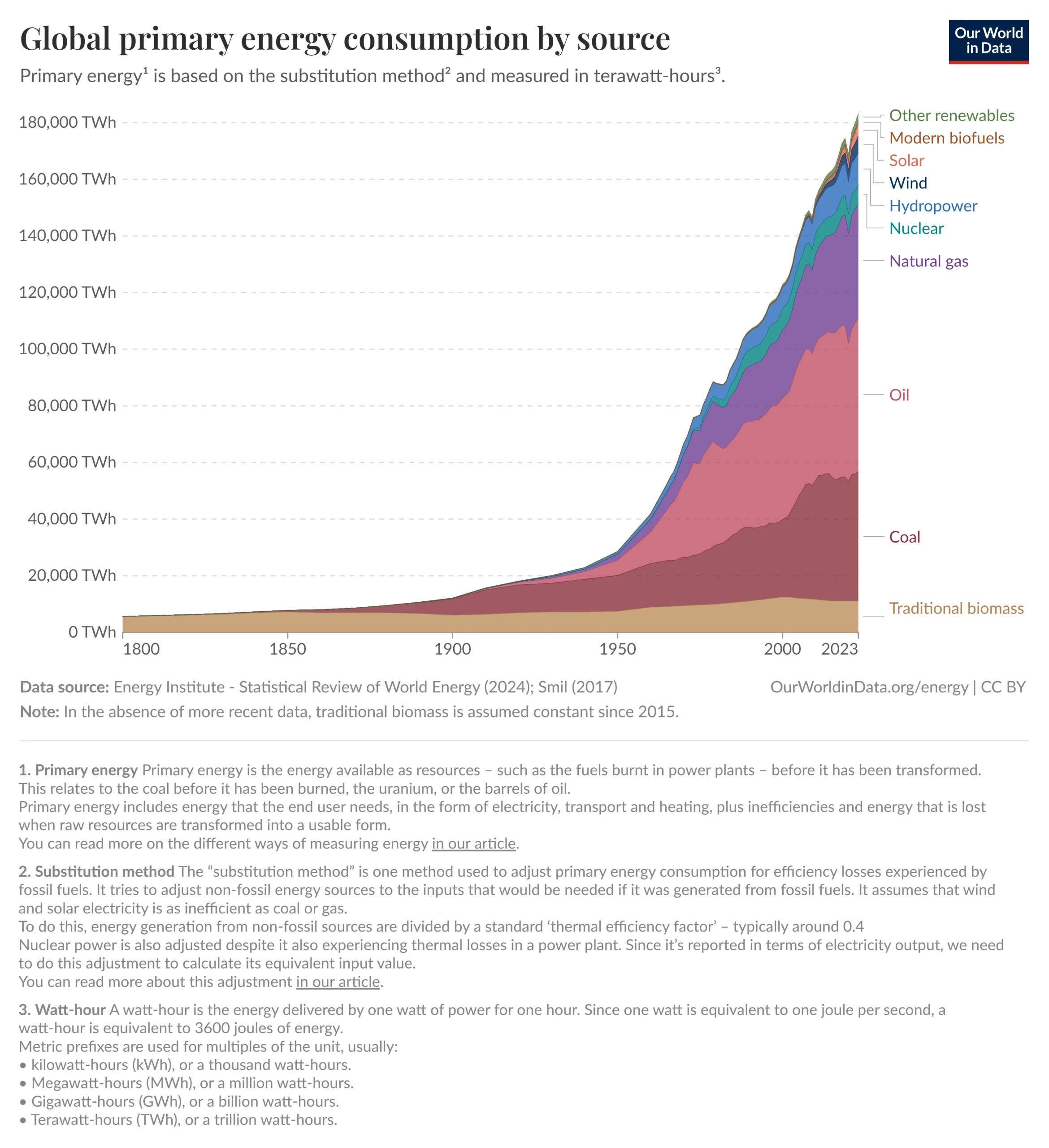

Energy consumption has skyrocketed and will continue to rise as the population of earth grows and as technology advances. This ever increasing demand for more energy puts more and more strain on the supply chain and infrastructure needed to produce and deliver energy.

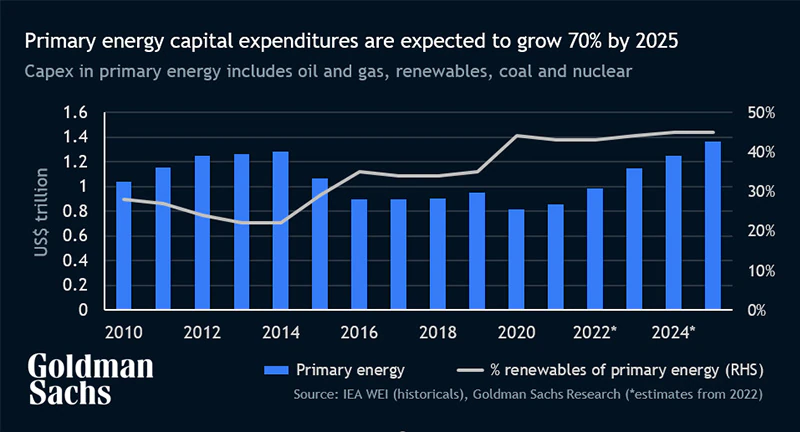

The world’s rapid push from fossil fuels towards green energies like Solar, Wind, and Hydropower is one of the issues causing high energy prices. This is because supply is not keeping up with demand for energy.

Currently green and renewable energies like Solar, Wind, etc. aren’t advanced enough technologically to even remotely keep up with traditional sources like Coal, Natural gas, or Nuclear.

In 2021 the world’s electricity production was as follows:

Coal: 36.31%

Natural gas: 21.10%

Oil: 2.55%

Nuclear: 9.93%

Hydropower: 15.15%

Wind: 6.60%

Solar: 3.66%

Other renewables, including Bioenergy: 2.70%

As you can see Fossil fuels and Nuclear dominate the production of electricity accounting for 71.89% of global production while renewables account for the remaining 28.11%

From here, we need to break down each source of energy so we can look at their current situation in 2022.

Fossil Fuels

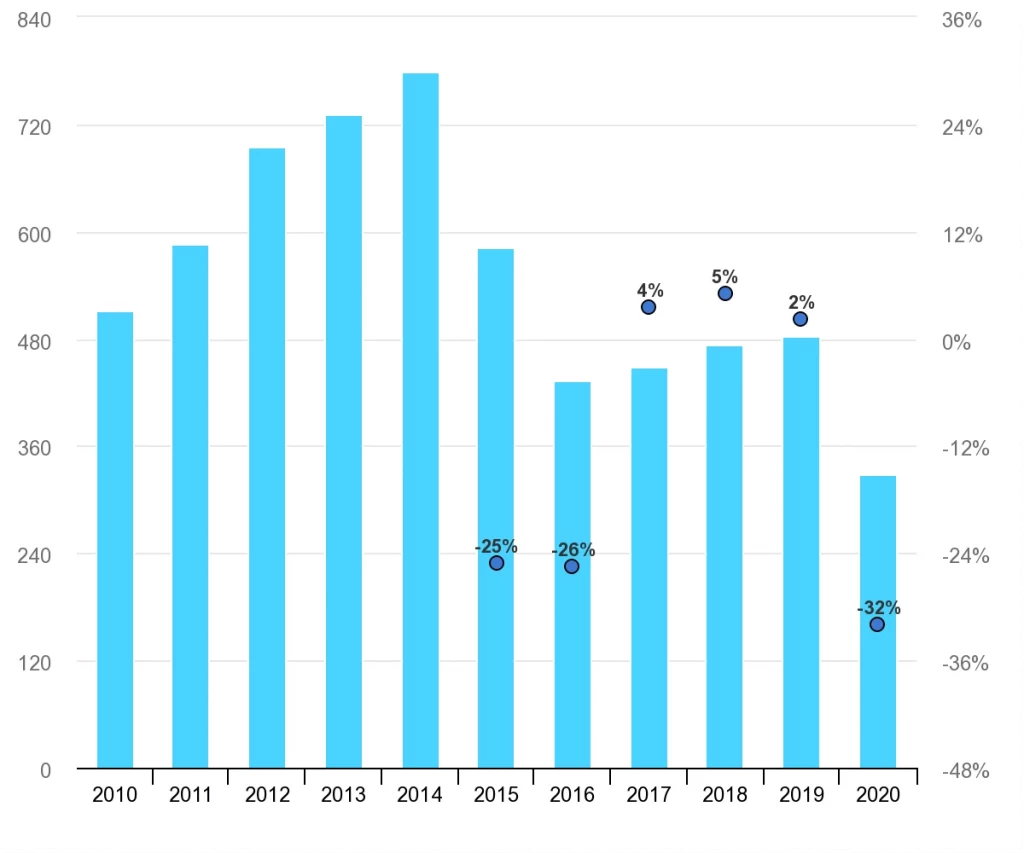

Even with the rally from last year on, the S&P 500 energy sector is down more than 20% from its 2014 all-time high and has underperformed the index itself by almost 300% since the beginning of 2010. This period of pain, however, has driven a rethinking across the industry. Companies are now focused on reducing investment and prioritizing returns and cash flows. This coupled with the push towards decarbonization has made investors wary and new investment into oil and gas has decreased dramatically in recent years.

As of November 2022, investments into oil and natural gas are set to boom as a large amount of supply is needed to keep up with the ever increasing global demand and Europe’s switch from Russian oil and natural gas.

Though there is significant new investment it will have little to no effect on short term energy prices. The average time to build a Nuclear plant is 5-7 years (some have taken a decade), pipelines can take anywhere from 2 years to over a decade, natural gas plants can take up to 6 years to complete, etc.

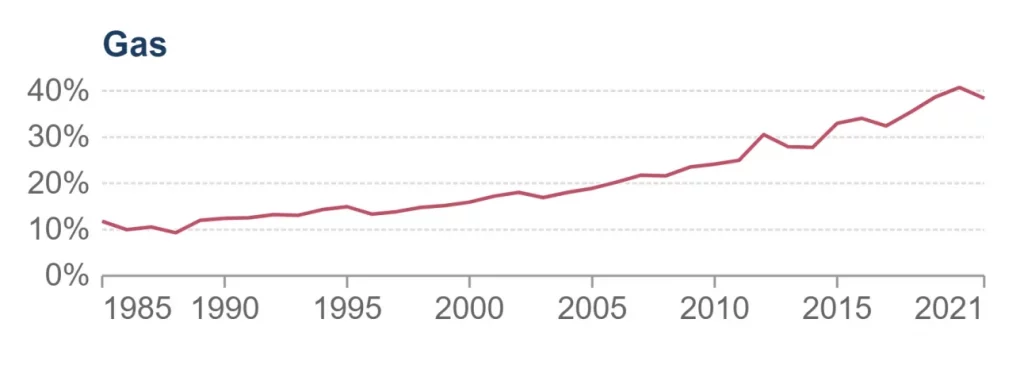

Natural Gas: Supply and demand for natural gas has increased drastically over the last couple decades as historically it is cheap, reliable, and the cleanest fossil fuel available.

The top 5 producers of natural gas are:

-

- United States: 934 billion cubic meters

- Russia: 701.7 billion cubic meters

- Iran: 256.7 billion cubic meters

- China: 209.2 billion cubic meters

- Qatar: 177 billion cubic meters

In the past couple years natural gas pricing has more than doubled domestically in the United States. Since 38.3% of electricity produced domestically is from natural gas, this directly increases the price of electricity.

The major factors that are affecting natural gas prices in the US are:

- The U.S has become the largest natural gas exporter in the world.

- Supply shortage of U.S. natural gas.

- The EU (European Union) plans to phase out all Russian natural gas by 2027 and the U.S. has since committed to shipping 50 billion cubic meters per year to the EU until at least 2030.

- China historically is the largest importer of natural gas in the world but because of covid lockdowns they have been selling their excess natural gas to the European and Asian markets. In October, 2022 they stopped all sales to ensure their own supply for the winter. This excess natural gas was crucial in helping make up for gas traditionally supplied by Russia.

- As of Dec 6, 2022 the U.S. agreed to supply 9-10 billion cubic meters to the UK over the next year.

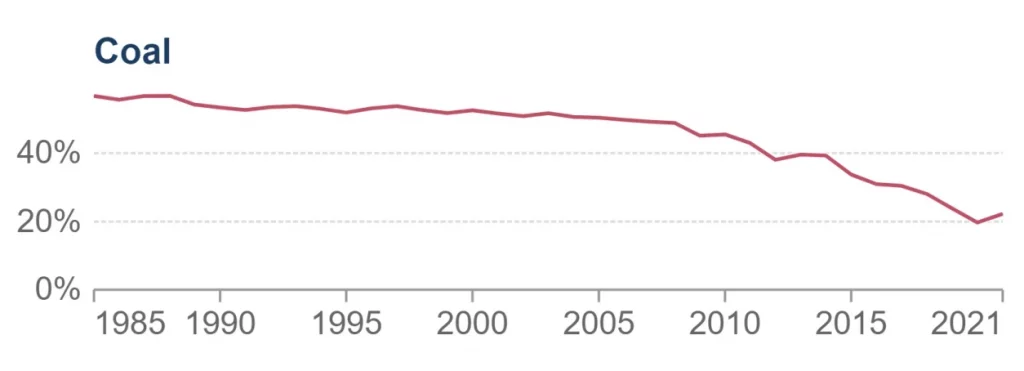

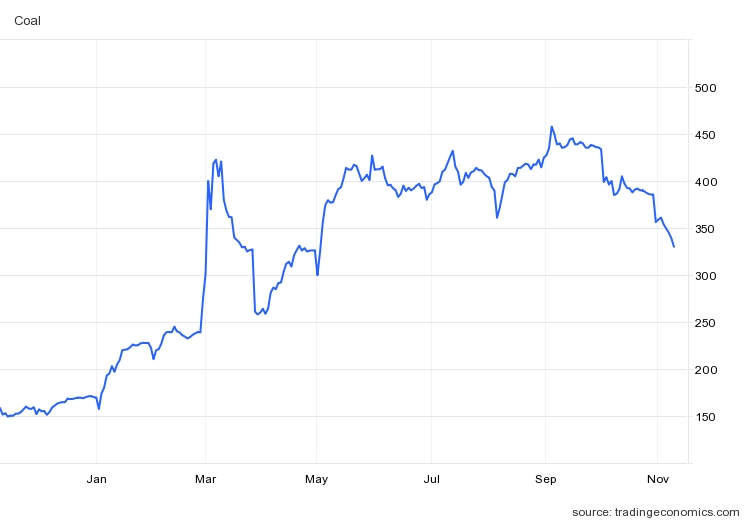

Coal: The use of coal to produce electricity has been a staple since the late 1800s as it is reliable and cheap. The situation with natural gas has caused demand for coal to increase and since coal is the 2nd largest producer of electricity in the US (21.8%), this has further increased electricity prices.

Over the past 40 or so years electricity produced by coal has dropped by nearly 40%.

Oil: Petroleum accounts for 0.5% of electricity generated in the US so if oil prices increase it doesn’t directly affect electricity pricing. Oil affects energy pricing in a more roundabout way. It causes the price of delivering the raw materials and goods to increase and this increases the cost of generating electricity, which then increases the cost to you as the consumer.

Oil overall has a small impact on energy prices compared to say coal, natural gas, or hydropower.

Nuclear Power

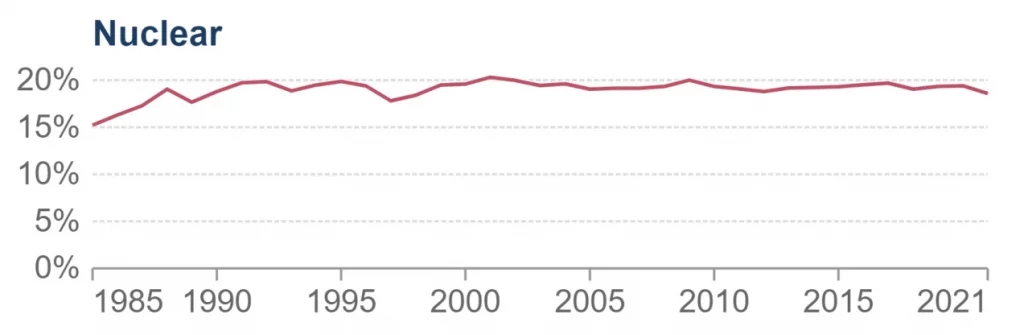

Nuclear power in the US accounted for between 17% and 20% of total electricity generated in the US for decades and remains consistent to this day.

Nuclear is being completely phased out in much of Europe, parts of Asia and various other parts of the world. As of 2022 Italy has permanently closed all of its nuclear power plants, Germany has shut down all but 3 (17 formerly), and many other countries have said they plan to phase out nuclear energy by 2030.

This decrease in electricity generation has caused and will cause demand for natural gas and coal to rise dramatically.

As a note, some countries are starting to rethink this due to climate concerns and energy independence.

Renewable Energy

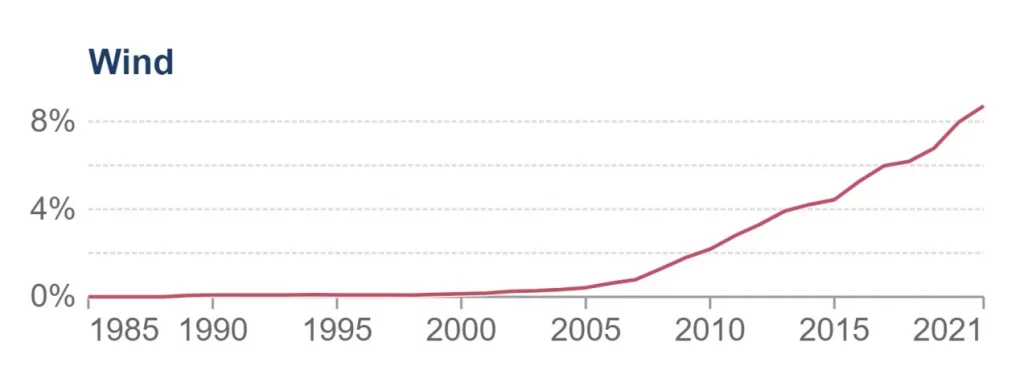

Wind: Electricity produced by wind has increased dramatically over the past 20 years, they still only accounted for 9.2% of the total electricity produced in the US in 2021.

With current technology wind cannot realistically scale to produce enough electricity to offset fossil fuels in the foreseeable future. Some of the challenges it faces are:

-

- Wind energy suffers from what is called intermittency, which is a disruption caused by the inconsistency of the wind itself. Since wind can blow at various speeds, it’s hard to predict the amount of energy it can collect at a given time. This means suppliers and cities need to have an energy reserve or alternative sources of power in case the winds die down for longer lengths of time.

- Optimal places to build wind sites are often remote places, not in urban areas that need them. So there is significant infrastructure needed to upgrade the US’s transmission network. Though offshore wind energy transmission and grid interconnection capabilities are improving, much more needs to be done and improved.

Wind turbines are also very loud and have visual impacts on landscape so even if there were places near large urban cities, these things would have to be taken into consideration.

Solar: In recent years solar has made large strides towards being a viable source of electricity generation. However, it still only accounted for 2.8% of electricity generated in the US in 2021. In order for Solar to even remotely compete with traditional methods of energy generation a massive amount of infrastructure needs to be built over the next couple decades and the technology needs to improve drastically.

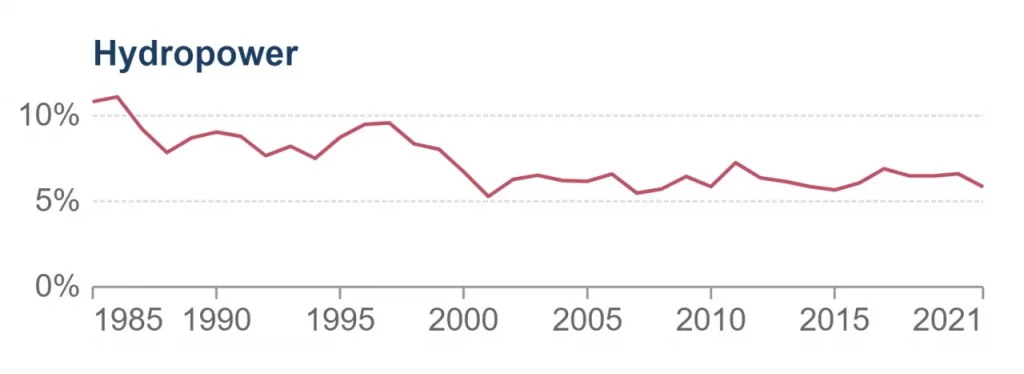

Hydropower: Hydropower accounted for about 6% of total electricity generated in the US in 2021. Though hydropower can potentially produce massive amounts of electricity and has in the past it has been generating less and less year over year across the globe.

While the technology for hydropower is readily available, the number of plants is obviously dependent on large rivers, which are finite.

Other renewables: Other renewables such as wood, landfill gas, municipal solid waste, or geothermal accounted for 1.3% of electricity generated in the US in 2021. These technologies need significant investment and research to become viable options for our energy needs.

Weather

Weather affects both supply and demand for energy. This can be from hot or cold weather increasing demand for cooling and heating respectively or by damaging infrastructure. Over the past few years here are some of the major weather events that have affected energy prices:

The freeze of 2021 in Texas

In February 2021, the state of Texas suffered a major power crisis, which came about during three severe winter storms sweeping across the United States in February. The storms triggered the worst energy infrastructure failure in Texas state history, more than 4.5 million homes and businesses were left without power, some for several days.

Heat waves around in 2021-22

Last year, the National Oceanic and Atmospheric Administration reported that 2021 tied with 1936 for the warmest summer on record. June 2022 trails behind last June 2021 but is still the sixth warmest June on record.

Around the globe in summer 2022, wave after wave of extreme heat waves occurred and summer isn’t over yet. Heat waves, particularly in Europe and Asia, caused thousands of heat-related deaths. On July 19, the U.K. had its hottest day ever recorded.

Storm related damages

Depending what state you are and what utility delivers energy to your area, you may get charged extra to help pay for damages to the infrastructure from storms like hurricanes, tornadoes, blizzards, etc.

Long Term Market Conditions

Things like inflation, war, shortages, a pandemic, etc. have long lasting effects to every industry and over the past 3 years there have been quite a few. The events that have hit the energy market hardest are:

The Pandemic

You’ve no doubt heard about supply chain issues, companies going out of business, etc. because of covid and while these things certainly have impacted the energy industry like they impacted everything else, there is a major issue unique to the energy sector.

Almost every state had moratoriums on utility disconnections because of Covid. Since millions of households could not pay their utility bills during the pandemic, there are billions of dollars in unpaid customer balances. These unpaid balances are being passed onto all customers, regardless of late payments or not.

Inflation

Inflation is the highest it’s been in decades which is further driving the cost of everything, including energy prices.

War in Ukraine

Between Russia shutting off pipelines to countries like Poland and Bulgaria for refusing to pay in Roubles, to the EU positioning to fully phase out Russian oil and gas and the uncertainties that war brings, there are dozens of ways this is affecting the global energy market.

OPEC+ cut oil production by 2 million barrels a day

OPEC and non-OPEC allies, a group often referred to as OPEC+, decided at their first face-to-face gathering in Vienna since 2020 to reduce production by 2 million barrels per day from November.

This cut in supply will further drive up energy prices.

Law and regulation changes

There are many federal laws and regulations regarding energy but the laws and regulations that have the largest effect on energy prices are state level energy mandates or regulations.

RPS standards: A renewable portfolio standard (RPS) is a regulatory mandate to increase production of energy from renewable sources such as wind, solar, biomass and other alternatives to fossil and nuclear electric generation. It’s also known as a renewable electricity standard.

It’s worth noting that several states have expanded their policies to incorporate additional resources in recent years. There is now a distinction between a “Renewable Portfolio Standard” (RPS) and what some states have labeled as a “Clean Energy Standard” (CES). The difference between a RPS and a CES comes down to how a particular state defines what is a “renewable” versus a “clean” source of energy. Clean energy typically refers to sources of energy that have zero carbon emissions.

As you can see, many states are rapidly pushing towards significant decrease in fossil fuel use or towards 100% clean energy. Until renewables are able to drastically increase their capacity to supply electricity, the rapid switch from fossil fuels will continue to drive prices up.

There are many other factors that drive energy prices but the ones covered above give you a solid overall picture of the market and what is happening globally.

What does this all mean?

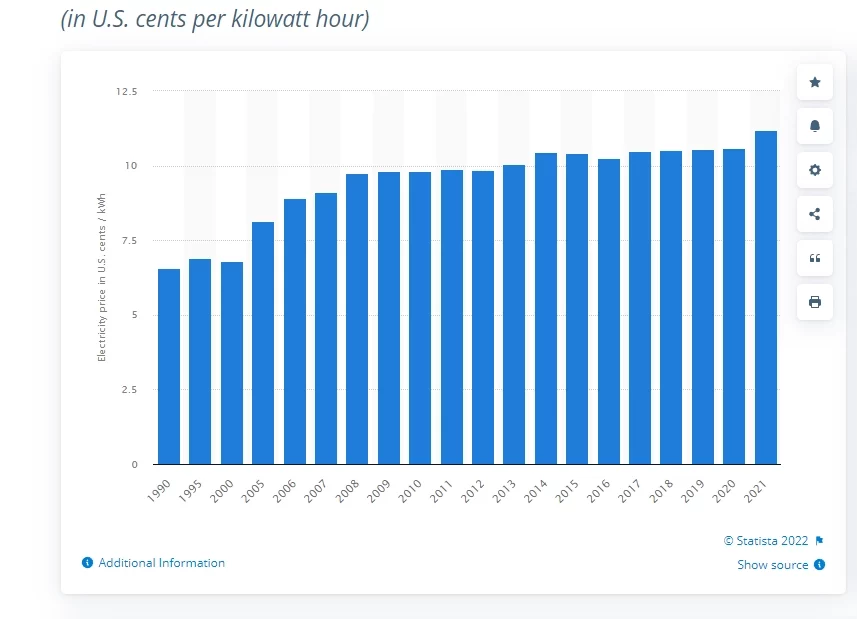

Electricity prices historically always go up and have been for decades, just like the price of everything.

As time goes on and technology increases, the need for energy continues to rise. Think back even just 15 years ago, how many things use electricity? Not many and now pretty much everything does.

The current situation caused a rapid increase in energy prices, which will become the new norm. There may be dips in Spring and Fall like there normally is as time goes on, but the market will stay in a high range for the foreseeable future… barring a major technological breakthrough or some other miracle.

What you can do about it

Luckily, there are things you can do to help offset these costs and protect yourself.

-

- Get a fixed-rate. If your business is located in a deregulated state, protect yourself from rising electricity rates and rising natural gas rates and get a Free Quote today.

- Be sure to follow energy best practices. Check out this article for more information.

- Upgrade to LED if you haven’t already.